Program content

Study business in a different way

The Bachelor of Business Management program has a 3-year structure. During the first year of the business management degree, you will learn the fundamentals of business; in the second year, you will consolidate these fundamentals and internationalize yourself through a semester-long exchange at a partner university; and in the third year, you will deepen your knowledge with one of our specialization tracks.

The future employability of the Bachelor in Management students is the principal factor that guides all our pedagogic activities. This degree creates competent professionals who can successfully fill the various roles at companies.

At the TBS Education campus in Barcelona, the subjects of the career in international business are grouped into the following blocks:

- Marketing

- Management control

- Economy, finance, and law

- Human Resources

- Operations

- Information management

- Career Starter

- Languages

Learn more about the program

Content year by year

The TBS Bachelor in Management allows students to decide on their own trajectories through the 3 years of a program that provides them with the practical experience and technical skills that are required in the labor market.

FIRST YEAR: Business Fundamentals

SECOND YEAR: Solidification & Internationalization

THIRD YEAR: Specialization

*Non-contractual information. Courses are subject to change every academic year.

FIRST YEAR: business fundamentals

During the first year of your bachelor of business administration, you will build a foundation of the basic concepts of the most relevant areas of companies and also begin language classes. At the end of the year, you will put your newly acquired knowledge to the test in a Business Game: a simulation of a company involving competing teams, which emphasizes business development and accounts.

- Management Control, Accounting and Auditing

- Economics, Finance and Business Law

- Information Operations and Management Services

- Marketing

- Human Resources & Business Law

- Career Starter

- Languages

- Internship

Alongside the classes, you will perform 35 hours of Citizen Service, a period of volunteer work at an NGO or non-profit association with social objectives, with the aim of training you to be a responsible and ethical professional. Finally, you will perform a minimum of an 8-week internship in customer relations.

SECOND YEAR: solidification and internationalization

During the second year, you will deepen your knowledge of the fundamental areas of a company and continue the language courses and Career Services. You will also perform a minimum of 8 weeks of internships as an assistant in a functional area of a company.

You will get international management degree experience and complete a semester exchange at one of our partner universities or on another of our campuses. If you are an international student, you can also choose to remain in Toulouse or Barcelona. Spending time abroad is a key part of a business management degree.

Popular Business Topics is the name we have given to an exciting semester where you can learn about different business-related subjects. Students complete their academic workload by choosing 6 out of 18 to 21 modules. Each module is delivered in one month, so the semester is very dynamic. Additionally, classmates are never the same.

It is a very international semester because, during this period, we welcome students from our campuses in Toulouse and Casablanca and several Exchange Students from partner Universities.

- Management Control, Accounting, and Auditing

- Information, Operations, and Management Sciences

- Marketing

- Human Resources Management & Business Law

- Career Starter

- Languages

- Internship

- Semester at a TBS partner university or at any of the TBS campuses

* Students entering directly into the second year of the Bachelor in Management program are required to study the entire year at the Barcelona campus.

THIRD YEAR: specialization

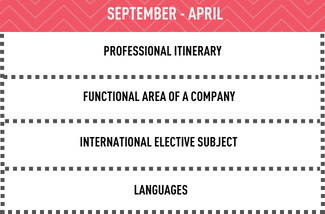

The third year is when you will undertake your specialization. You will be able to tailor your academic program and select one of our professional itineraries, a functional area of a company, and an international elective subject, in addition to continuing the language classes and the Career Starter.

Professional itinerary

Through the professional itinerary you will specialize in a sector or business area by choosing from the following:

- Hospitality & Tourism Management (in English)

- Aviation Management ( in English)

- International Business Management (in English)

- Innovation Management (in English)

- Event Management (in French)

- Wine Marketing & Oenotourism (in French)

- Real-estate Management (in French)

- Digital Business (in French)

- Business Development (in French)

- Sports Management (in French)

- Fashion & Luxury Management (in English)

- Digital Marketing (in English)

- Digital & Social Entrepreneurship (in English)

- Doing Sustainable Business (in English)

- Data Science for Business (in English)

- Digital Business (in French)

- International Business Management (in English)

- New track (TBC)

- Distribution & Commerce in apprenticeship (in French)

- New professional path coming soon

Functional competence

You will also have the opportunity to deepen your knowledge of a functional area of a company that you have an affinity for:

- Corporate Finance (FR/ENG)

- Performance Management (FR/ENG)

- International Business (FR)

- Operational Marketing (FR/ENG)

- Human Resource Management (ENG)

- Procurement & Supply Chain Management (FR)

- Corporate Finance (ENG)

- Operational Marketing (ENG)

- Human Resource Management (ENG)

- Data Analytics (ENG)

- Corporate Finance (ENG)

- Operational Marketing (FR)

- New competence in development

Finally, you must select an international elective subject that guest professors will deliver from around the world to strengthen your specialization and internationalization. You will end the academic year with a minimum of a 16-week internship at a company, where you will collaborate on the management of a project.

Internship at companies

This bachelor in business management includes compulsory full-time internships in every year of the program. This adds up to three internship periods, which are full-time and happen after the lessons period has ended. In addition, they are progressive internships, which means that they increase each year in terms of duration and the responsibility you are given within the company.

As a result, graduates already have about a year of professional experience accumulated (compulsory minimum in order to graduate: 8 months) by the end of the Bachelor program.

The internships enrich the curriculum for the students and facilitate their integration into the workforce in a highly significant way. They also help students to discover what they do and do not like, as they work in various departments and sectors.

As long as the internships match all the school’s requirements, they can be completed in any type of company, sector of activity, or country.

| Bachelor 1 | Sales or customer relations internship. | Minimum 8 weeks. |

| Bachelor 2 | Internships as an assistant in a functional area of a company. | Minimum 8 weeks. |

| Bachelor 3 | End-of-degree internships in project management. | Minimum 16 weeks. |

During the internships, students have follow-ups with their Career Starter coach. At the end of each internship period, an assessment of the internship will be conducted.

The school shares internship offers and company contacts with the students, along with a list of contacts for the internships carried out by former students. However, it is the responsibility of the Barcelona campus students to seek out their internships; an important learning experience before taking the plunge into the working world.

Civic Engagement

The Civic Engagement that is part of the Bachelor’s program aims to instill a sense of responsibility and an awareness of the reality of today’s society in our students through volunteering at solidarity organizations. Bachelor students must dedicate a total of 40 hours to supporting an NGO or association with social aims.

These are some of the organizations in which the TBS Education students collaborate to complete their Civic Engagement project.

- Cáritas

- Catnova

- Pure Clean Earth

- Amics de la Gent Gran

- Afev

- Acción Planetaria

- Fundación Roure

- Sant Egidio

- Asociación Gabela

- Ohlala Festival

- Voluntaris Itinerantes

- Voluntaris 2000

To complete the number of ECTS credits of the Bachelor in Management program, students can also join the Ambassadors project and become the best representatives of the school at open days, fairs, or information sessions.

Teaching and assessment methodology

The teaching methods at TBS Education both for TBS master and bachelor students, are diverse and combine presentations, professional and researcher conferences, workshops for the development of management skills, case study work sessions, the intensive use of teamwork, and the development of projects.

There is no single method of evaluation, a combination of assessment instruments are used for each subject, including exercises, short tests, projects, essays, case studies, and exams. Unconventional methods like the assessment of participation, challenges, assessments from peers (between students), and self-assessment are also used.

Qualification obtained

Once students have completed their studies, they will obtain the Bachelor in Management official degree, awarded by the French Ministry of Education. The corresponding diploma will be awarded in October of the graduation year.

At the beginning of 2022, TBS Education obtained the degree of license for the Bachelor in Management, which certifies the academic quality of the program.

Academic Regulations

The academic regulations outline the rules and requirements that students must adhere to in order to successfully complete their academic program. These regulations are established by TBS Education to ensure consistency, fairness, and quality in the academic process.

More information on our Business Management Degree

If you need more information about our business management degree do not hesitate to contact our Admissions Department.